Apple's valuation stands at $3.5 trillion but the company isn't doing much in terms of innovative. Nvidia, on the other hand, is a different story.

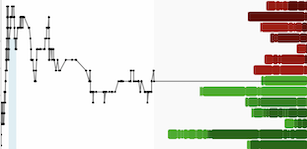

Nvidia stock soared to a record high on Monday, closing up 2.4% at $138, fueled by strong demand for its new Blackwell supercomputing AI chips.

This marks the second time this year that Nvidia shares have reached an all-time high, the first being in June.

A broader rally in the technology sector also contributed to record closes for both the Dow Jones Industrial Average and the S&P 500.

After a sell-off in early September due to sector rotations and a Department of Justice antitrust investigation, Nvidia shares bounced back in October, rising 18% from the previous month and up more than 187% year-to-date.

With Monday's close, Nvidia’s market capitalization surpassed $3.4 trillion,making it the world’s second-largest company, right behind Apple, which boasts a market cap of $3.51 trillion. The difference is that Nvidia is staying at the cutting edge, reporting $30 billion in revenue for the June quarter, while Apple is grappling with slowing sales.

If Nvidia's stock surpasses $141, it could overtake Apple and become the most valuable company in the world. While it's uncertain if that will happen, Nvidia is clearly on a strong upward trend.

The demand for chips that power AI technology is driving Nvidia’s success, and there’s no sign of that slowing down. Nvidia’s new Blackwell AI chip, expected to cost between $30,000 and $40,000, is already "insanely" in demand, with all production sold out for the next year, according to CEO Jensen Huang.

In the past week, analysts have reinforced their optimism about Nvidia, which is likely helping boost the stock. Citigroup recently rated Nvidia as a "buy" with a price target of $150 per share, while Goldman Sachs analysts also raised their price target to $150.

Nvidia's success is also lifting other companies in its supply chain. South Korean chipmaker SK Hynix, which produces high-bandwidth memory chips for Nvidia's AI applications, saw its shares rise by 2.8%. Samsung Electronics, expected to manufacture HBM chips for Nvidia, saw a 0.5% gain. Taiwan Semiconductor Manufacturing Company and Hon Hai Precision Industry (Foxconn), both key players in Nvidia's supply chain, jumped 2.4% and 3.5%, respectively.