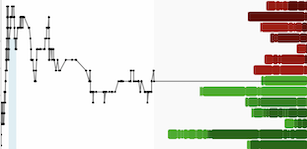

Metals & mining investors are beginning to experience an unusual market environment for them - one to which they aren't accustomed. It's a bull market, you know.

Some investors might be beginning to feel like it's too good to be true, and that they must be dreaming. While we are sure to experience plenty of twists and turns in the coming months, the most bullish thing markets can do is to go up. Copper, gold, and silver are rising, and the mining stocks are following suit.

Those who have been paying attention and were well positioned have already generated 30%-50% portfolio gains in the last couple months. As always happens, the rising metals and mining share prices have attracted some attention in recent weeks and the bullish boat is beginning to fill up.

Considering the current market environment, I figured it was a great time to remind ourselves of some bull market wisdom from market legends. These quotes offer timeless wisdom that is worth reminding ourselves of every couple years. In fact, I would argue that in today's hyper-speed market environment these legends' quotes are more valuable than ever:

"There is only one side of the market and it is not the bull side or the bear side, but the right side."

~ Jesse Livermore

"I mean, you know, bull markets make a lot of people very smart." ~ Ed Yardeni

"Bull markets can obscure mathematical laws, but they cannot repeal them." ~ Warren Buffett

"The worst crime that an analyst can commit is remaining bearish in the face of a rising market." ~ Richard Russell

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." ~ Sir John Templeton

“The longer the bull market lasts the more severely investors will be affected with amnesia; after five years or so, many people no longer believe that bear markets are possible.” ~ Benjamin Graham

“Market extremes represent inflection points. These occur when bullishness or bearishness reaches a maximum. Figuratively speaking, a top occurs when the last person who will become a buyer does so. Since every buyer has joined the bullish herd by the time the top is reached, bullishness can go no further, and the market is as high as it can go. Buying or holding is dangerous. Since there’s no one left to turn bullish, the market stops going up. And if the next day one person switches from buyer to seller, it will start to go down.” ~ Howard Marks

"A bull market is like sex. It feels best just before it ends." ~ Warren Buffett

"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves." ~ Peter Lynch

"Men who can both be right and sit tight are uncommon." ~ Jesse Livermore

"The fraud cycle follows the financial and business cycle with a lag. And that is as bull markets go on, people’s sense of disbelief is reduced and they begin to believe things that are too good to be true. It’s human nature. And bad people take advantage of that." ~ Jim Chanos

"Bulls will patiently explain that "it is different this time" .. Of course, any contrarian knows that just as a grim present is usually a precursor to a better future, a rosy present may be a precursor to a bleaker tomorrow." ~ Seth Klarman

"The most bullish thing the market can do is go up." ~ Paul Montgomery

“Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks. Then get out of all your stocks; get out for keeps! You have to use your brains and your vision to do this; otherwise my advice would be as idiotic as to tell you to buy cheap and sell dear. One of the most helpful things that anybody can learn is to give up trying to catch the last eighth-or the first. These two are the most expensive eighths in the world.” ~ Jesse Livermore

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.